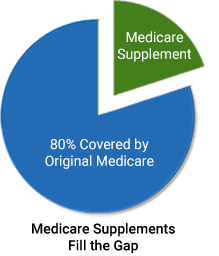

Medicare Part A and part B provide insurance coverage for health related expenses, however it was not intended to be full coverage. Most Medicare beneficiaries do not rely on original Medicare alone. Straight Medicare covers 80% of part B services, leaving the beneficiary paying 20% (with no cap to the out of pocket costs). A Medicare Supplement was created to help fill the gaps that Medicare does not cover. This type of coverage is also referred as a “Medigap” plan.

The beauty of a Medicare Supplement is that Medicare will remain your primary coverage which allows you the freedom to see to any doctor or hospital that accepts Medicare. Medicare will pay your medical expenses first, and then your Medicare Supplement will pay the remaining balance. Depending on which Supplement plan you choose, you may be responsible for some deductibles and or co-pays.

All Supplement plans are standardized by Medicare. This means that regardless of which insurance carrier you choose, the plans benefits are the same. The only difference is the plans monthly cost.

Below are three of the most popular Supplement plans!

Medicare Supplement Plan F is the Cadillac of all plans. It pays 100% of the costs that Medicare does not cover. This means that when you have Medicare supplement Plan F, you will not pay any deductibles or co-pays because the Plan F pays 100 percent! The Supplement Plan F is only available to Medicare recipients who were enrolled or eligible for Medicare prior to January 1, 2020.

Medicare Supplement Plan G has become more and more popular because of affordability and benefits. It works exactly like Plan F, except for the Part B deductible. You are responsible for the Part B deductible each year, and after that, it pays everything else. In 2024, the Part B deductible is $240 per year.

Medicare Supplement Plan N works similarly to the Plan G. With the Plan N you are responsible for your Part B deductible ($240 for 2024) and doctors co-pays which range from $0-$20 per visit. You will also have a $50 co-pay for emergency room visit. Plan N will usually have lower premiums than Plan F or Plan G, however you will have more cost sharing with Plan N.